|

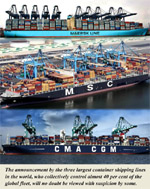

THE

world's three largest shipping lines, Maersk

Line, MSC and CMA CGM, issued a joint statement

earlier this week announcing a "long-term

operational alliance on East-West trades,

called the P3 Network", in a bid to

improve customer service and operational

efficiency.

But

while improved customer service and a desire

to increase efficiency are admirable goals,

one cannot ignore the potential impact that

this move could make in the wider container

shipping industry. Nor can one ignore the

regulatory interest that will be aroused

accompanying this news.

This

publication in recent months has speculated

that the market is now witnessing a period

of covert consolidation on the mainline

trades that will ultimately leave the Asia-Europe,

transpacific and transatlantic trades with

a much smaller pool of service providers

than what we see today.

This

week's announcement from the "Big 3"

certainly adds greater weight to this assertion....

click image

to enlarge click image

to enlarge

Already

Maersk Line operates 15.1 per cent of the

world's container shipping capacity, MSC

commands 13.5 per cent and CMA CGM operates

8.6 per cent, according to Alphaliner.

Collectively

these three lines operate an astonishing

37.2 per cent of the world's container shipping

fleet. As such, any major alliance particularly

on the world's three major trade lanes is

of great significance.

All

three carriers generate most of their business

and revenue on these trades, which would

indicate that their market share could be

even more if we broke it down on a trade-by-trade

basis, particularly Asia-Europe.

Nevertheless,

it is clearly stated in the announcement

that while the vessels deployed on the P3

Network, which will amount to 2.6 million

TEU in capacity across 255 vessels on 29

loops initially, will operate independently

by a joint vessel operating centre, the

three lines will continues to have fully

independent sales, marketing and customer

service functions.

No

doubt this is said in the hopes that it

will keep the attack dogs of the European

Commission at bay, who will certainly be

taking a keen interest in how this alliance

manifests itself.

Shipping

lines know all too well the heavy penalties

they face for collusion. And given the huge

potential market share involved with the

world's three largest shipping lines operating

in close connection with one another regulators

will be keen to ensure that everything is

above board.

With

all of this said it is important to note

that the agreement, as was reported in our

sister publication the Hong Kong Shipping

Gazette yesterday, is not expected to take

effect until the second quarter of next

year and is still subject to approval from

the relevant regulator authorities concerned

with each of the three trades.

It

is also subject to final negotiations among

the three carriers. But the motivation to

get the deal done will be high, given the

potential for significant operational cost

savings.

As

the deal currently stands Maersk will contribute

42 per cent of the capacity to the tune

of 1.1 million TEU; MSC will deploy 34 per

cent of the capacity, or roughly 900,000

TEU, while CMA CGM will contribute 24 per

cent or 600,000 TEU.

Outside

of the regulatory issues this news could

have significant repercussions for other

carriers in these three trade lanes, as

one would imagine that the economies of

scale advantage these three carriers will

enjoy will grow to a new unprecedented level.

Page 1 2

[Next]

|