|

BIG

is beautiful in the container shipping sector.

At least that's what many industry insiders

today are saying.

Regardless

of where one stands on the issue of whether

size matters in the shipping industry or

not, the results are hard to ignore. If

we look at operating profits alone, it would

appear that bigger is better...

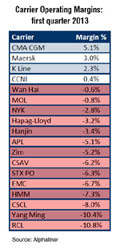

Maersk

Line, the world's largest shipping line,

and CMA CGM, the world's third largest,

topped all carriers in their financial performance

for the first quarter of the year....

click image

to enlarge click image

to enlarge

MSC,

which is currently ranked number two in

terms of fleet size, is privately owned

and has released no details of its financial

performance to date.

Marseilles-based

CMA CGM posted a first quarter operating

profit of US$196 million, according to Alphaliner,

which was good enough to give it an operating

margin of 5.1 per cent, which is impressive

for a shipping line.

Maersk

came in at a close second with a profit

of $189 million and a margin of three per

cent.

Drewry

Maritime Research, in its Container Insight

publication, said that the "big three"ˇXMaersk,

MSC and CMA CGMˇXall boast strong economies

of scale, which on the transpacific trade

currently translates into deploying ships

that are 32 per cent larger than the average

vessels sailed by other carriers on the

route.

The

average active vessel size of the top three

liners reaches 8,550 TEU, while the overall

average ship size in the industry is only

6,490 TEU, according to Drewry's figures.

Drewry

believes this explains why CMA CGM and Maersk

were able to earn more than other major

carriers at EBIT (earnings before interest

and tax) level in 2012, and continued to

surpass other smaller rivals in terms of

profitability in the first quarter of this

year.

"It

also explains why carriers, such as APL

and Hanjin, whose transpacific cargo accounts

for a large proportion of their total liftings

(29 per cent and 41 per cent respectively

in the first quarter of 2013), yet operate

vessels well below the average size, were

amongst the poorest," said the Drewry's

report.

Alphaliner's

figures show that Singapore's APL was the

worst performer among the 18 carriers. It

suffered an operating loss of $101 million

and had a negative margin of -5.1 per cent

in the first quarter.

Korea's

Hanjin also lost $65 million in the first

three months of the year with a negative

margin of -3.4 per cent.

Alphaliner

said that among the 18 carriers that posted

their first quarter results, only four ˇV

CMA CGM, Maersk, "K" Line and

CCNI ˇV were able to operate in the black.

The

operating losses for the rest of the 14

carriers totaled $762 million. The aggregate

losses, while large, did show a significant

improvement as the same 18 carriers surveyed

had totally lost $1.89 million in the first

quarter of 2012.

Another

upside is that there is little risk of any

carrier being forced out of the market in

the near terms as all have reportedly been

able to secure financial backing during

this difficult operating period.

Page 1 2

[Next]

|