|

Page

2 of 3

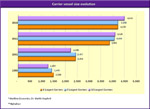

After

two decades the average vessel size for

these carriers had increased to between

2,200 TEU and 2,500 TEU - an increase of

roughly 1,000 TEU or more than 60 per cent.

click image

to enlarge click image

to enlarge

In

the past 12 years the increase has been

even more dramatic. From 2001 to 2011 the

average size increased by more than 80 per

cent to over 4,000 TEU.

Today

the average vessel size for the 10 largest

carriers is 4,511 TEU, which is roughly

250 per cent more than what it was in 1980.

Given

the industry's orderbook today the average

vessel size is destined to continue climbing

in the coming years, particularly with Maersk's

Triple E class ships, which have a nominal

handling capacity of 18,000 TEU, entering

the market later this year.

The

increasing size of the average containership

has had multiple effects on the market today.

Firstly it has helped reduce unit costs

for those carriers that have the largest

vessels. Secondly, due to the perceived

cost benefits it has spurred more lines

to invest in larger vessels as well.

But

in spite of the perceived benefits the rush

to upsize has also contributed to the severe

supply overhang in the sector today.

It

has also contributed to what we will see

below as the subtle or silent consolidation

of the market.

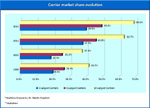

In

the chart below we can see the evolution

of the carriers' market share, in terms

of capacity deployed, from 1980 to 2013.

click image

to enlarge click image

to enlarge

In

1980 the top 10 carriers in the sector held

a market share of 41.5 per cent. The top

three carriers alone held just a 20 per

cent market share in terms of active tonnage.

Essentially,

we can say that the container shipping industry

was rather fragmented at that time.

It

became even more fragmented by 2001 when

the ten largest carriers commanded 37.3

per cent of the market share, and the top

three held just 18.4 per cent.

Page 1 2 3

[Next]

|